PBCs are incorporated under the Corporations (Aboriginal and Torres Strait Islander Act) 2006 (CATSI Act) which sets out their responsibilities to the corporation and its members. Under the Native Title Act 1993 (Cth) (NTA) PBCs also have obligations to the common law native title holders.

ORIC defines corporate governance as:

How people lead and run their organisations. Corporate governance is mainly the responsibility of the board as a group. The governing board performs its duties with the support of management and staff, in line with members’ wishes, the constitution and the law, and ideally in partnership with stakeholders (see ORIC).

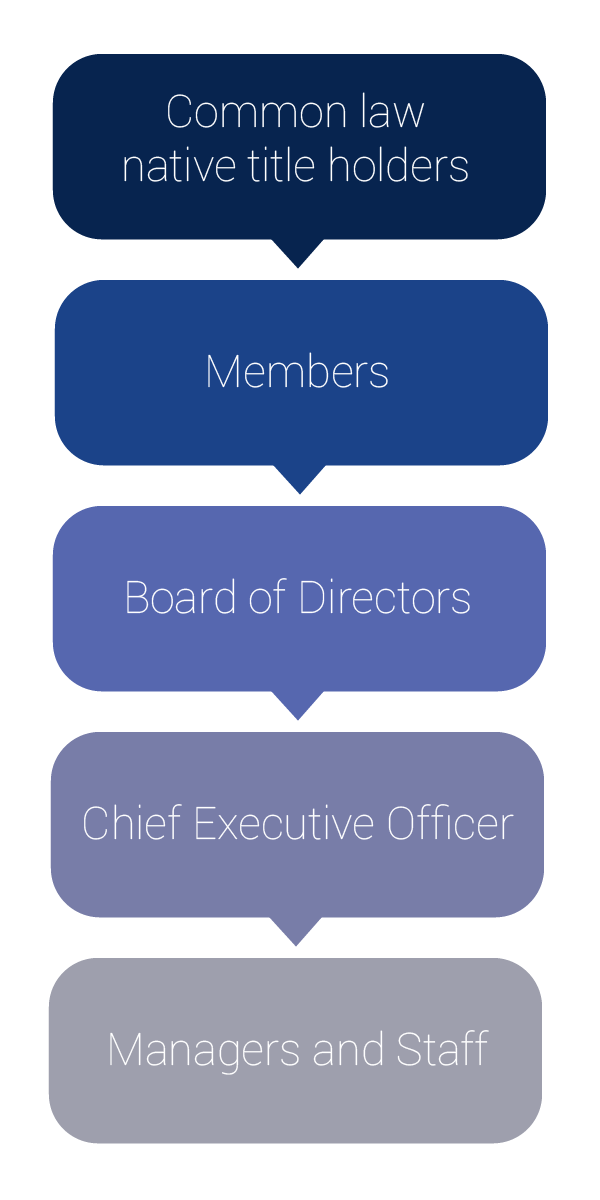

As a general rule a PBC structure will include: common law native title holders; PBC members; PBC directors; chief executive officer (CEO); and managers and staff.

Common law native title holders must be consulted for native title decisions under the NTA and Native Title (Prescribed Bodies Corporate Regulations) 1999 (PBC Regulations).

It is important to note that following a successful native title determination, native title holders do not automatically become members of a PBC and it is not compulsory that they become members. However, if they wish to become members they can either apply before the PBC is registered (membership by registration), or apply in writing to the directors of the PBC to become members after the PBC is registered (membership by application).

PBC members are responsible for setting up a PBC and electing the board of directors. Members have certain rights regarding the internal operations of a PBC such as: voting at general meetings and Annual General Meetings (AGM) ; removing directors (according to the rule book and the CATSI Act s 249-10); and making changes to the rule book.

PBC directors are elected by the members and are responsible for the governance of the corporation and for ensuring its performance is aligned with its values, aims and objectives. All PBCs are required to have a board of directors. Typically, directors are responsible for developing and overseeing strategies to achieve the aims of the PBC and manage governance risks. The directors are responsible to the PBC members and common law native title holders.

The CATSI Act (s 243-1 and 243-5) states that PBCs will have between three and twelve directors. PBCs can apply to the ORIC Registrar for an exemption if their circumstances make it appropriate for them to have more than twelve members to represent all native title holders.

The Chief Executive Officer (CEO) is appointed by the directors and reports to the board. The CEO is accountable to the directors and members and is usually responsible for the day-to-day operations of the PBC to achieve its aims and objectives as set out in its strategic plan. The PBCs policies and procedures should clearly outline the delegation of responsibility to the CEO.

Managers and staff are appointed by the CEO. Depending on their size, needs and resources, some PBCs employ full or part-time, and these may include the CEO, administrative and/or legal support staff, land management and cultural heritage staff.

Governance is not a ‘one size fits all’ concept. Each PBC is different and the approach to governance will depend on the size, structure, and culture of the PBC. In medium to large PBCs it is usually considered best practice for the duties and responsibilities of the directors and CEO to be separated. You could say that the board sets the organisation’s direction while the CEO focusses on achieving that direction. For small PBCs with limited resources it may be the case that directors will need to be more involved in the day-to-day operations of the corporation (see Australian Institute of Company Directors).

There is usually some crossover between the strategic responsibilities of the board and the management responsibilities of the CEO, and it is important that there is a good working relationship between the board and CEO to manage this overlap. ORIC states that having a rule book that is carefully followed and works well for a corporation is essential to maintaining good governance.

Directors duties

Most corporations under the CATSI Act have limited liability, which means that members do not usually have to contribute to the debts of the corporation if it fails. However, directors can be held liable if they have not fulfilled their duties. It is therefore important that directors understand their legal duties under common law and the CATSI Act. These are:

Duty of care and diligence: Directors must take their responsibilities seriously and ensure they are prepared and informed to make decisions. This means they understand their legal obligations under the NTA, CATSI Act, PBC Regulations and their rule book; they attend all directors’ meetings; and they know the financial position of the PBC.

Duty of good faith: Directors must always act in the best interests of the PBC without considering their own or their family’s personal interests. All decisions directors make must be in the best interests of the PBC as a whole.

Duty to not improperly use position or information: Any information directors obtain in their role must not be used for their own, or some else’s personal benefit, or for reasons that may harm the PBC.

Duty to disclose material personal interests: Directors who have a material personal interest (also referred to as a ‘conflict of interest’) in a matter involving the PBC have a duty to disclose that interest to the other PBC directors. This is because a director may not be able to act in the best interests of the PBC if a particular decision is likely to benefit a director in any way. It is not unusual for PBC directors to face conflicts of interest from time-to-time, and there is nothing wrong with this. However, it is important that these are managed openly and transparently in accordance with the PBC’s conflict of interest policy.

Duty to not trade while insolvent: It is important that directors know the financial position of the PBC so that they can ensure that it has enough money to pay any bills that are due. To be ‘insolvent’ means to be unable to pay your debts when they fall due. A director may be in breach of this duty if they make a financial decision that causes the PBC to become insolvent.

Further resources

- Good governance principles and guidance for not-for-profit organisations, Australian Institute of Company Directors, 2013

- Understanding governance, Indigenous Governance Toolkit, Australian Indigenous Governance Institute (AIGI), 2012

- Good governance guide, Victorian Local Governance Association, 2012

- Corporate governance, ORIC

- Common law native title holders, PBC website

- PBC members, PBC website

- PBC directors, PBC website

- CEO, PBC website

- Managers and staff, PBC website

- Board of directors, PBC website

- Board Code of Conduct template, PBC website

- Directors duties factsheets, ORIC